Stitch Labs is an operations management platform for scaling, high-growth brands looking to increase their bottom-line.

Almost every scaling retailer has one goal: to increase the bottom line. Adware download mac. But increasing the bottom line doesn’t just mean increasing sales. There are other ways that businesses can streamline for efficiency and use creative strategies to increase profits from existing sales — that’s where markup vs margin comes into play.

Retailers mark up the prices of products before selling them to customers, and they earn a margin on each sale, shown clearly on their retail reports.

But understanding what’s the difference between markup and margin goes a little further than that. Let’s look at how they compare and how to calculate markup and margin.

What is markup?

Markup is the amount that a retailer adds to price of a product before selling it to a customer. The markup ratio is the percentage difference between the actual cost of goods sold (COGS) and selling price.

Understand your true cost of goods sold (COGS) with inventory and purchasing software made for brands.

Retailers use markup to increase the selling price of products so that they can cover overhead and turn a profit. Without markup, retailers wouldn’t make any money off of their sales because they’d be selling products for the same cost to acquire them, essentially breaking even.

Markup is the amount that a retailer adds to price of a product before selling it to a customer. The markup ratio is the percentage difference between the actual cost of goods sold (COGS) and selling price. Understand your true cost of goods sold (COGS) with inventory and purchasing software made for brands. Markup (or price spread) is the difference between the selling price of a good or service and cost. It is often expressed as a percentage over the cost. A markup is added into the total cost incurred by the producer of a good or service in order to cover the costs of doing business and create a profit.

The higher the markup, the higher the price. Businesses may use a markup ratio if they sell several different products and need to ensure profitability across the board. In some cases, a flat markup of $X is added to every product, regardless of how much it costs to produce.

You may have also heard the term “retail markup,” which many use to describe the difference in price from wholesale and direct-to-consumer.

What is margin?

Margin is the amount of profit that a retailer makes on a sale, after accounting for the COGS. This is essentially the money that a retailer can put into their bank account after making a sale. Margin, or gross profit margin, is calculated by subtracting the revenue from the COGS.

Businesses will typically calculate the margin percentage or gross margin ratio, which is the percentage difference between the selling price and the COGS.

In this case, the higher the margin, the higher the profits for the business. Some retailers have a margin goal that they work towards for all products. Margin also plays a major role in demand forecasting, budgeting, inventory accounting, and other core business tasks.

Markup vs margin: What’s the difference?

When it comes to markup vs margin, there are many commonalities but also key distinctions. Let’s start with what markup vs margin similarities there are:

- Both markup and margin use COGS and price as data inputs.

- Markup and margin are closely related to one another.

- Understanding both can help retailers price more profitably.

But when it comes to discussing what is the difference between markup and margin, the list is a bit longer.

When talking about markup, we’re looking at the cost or price of the item for the customer. When we look at the margin, we’re analyzing the monetary value to the business. Margin is more of a behind-the-scenes metric, whereas markup is customer-facing.

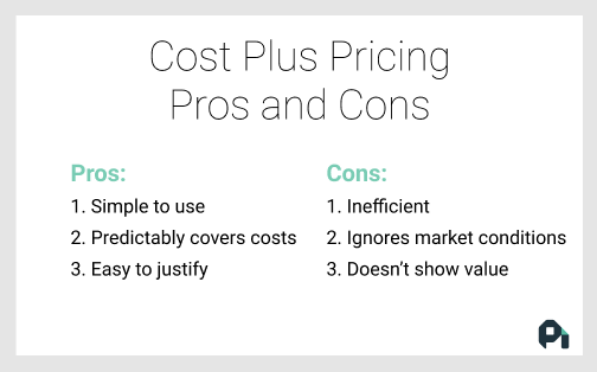

In comparison to markup, margin provides a more accurate look at actual earnings. That’s because markup uses the price as the divisor, whereas margin is based on the true cost to the retailer. Markup often overestimates earnings, and it doesn’t account for indirect costs.

But that doesn’t mean markup holds no value. In fact, markup is where you should get started. It’s an easier metric to wrap your head around, for one, but it also affects your margins. While markup isn’t a direct input into the margin formula, it does affect the price — which is one of margin’s inputs.

Once you apply markups, you can assess how that affects your margins.

Also, basing your pricing on margins (more on that later) makes it easier to predict profitability than if it were based on markup. Pricing based on markup may lead to significant spikes or drops in your profits.

How to calculate markup and margin

Unfortunately, we’re unaware of any margin vs markup calculator. But, before we dive into the mathematics behind how to calculate markup and margin, let’s define some of the variables we’ll be using:

- Price/revenue: selling price to customer

- Cost/cost of goods sold (COGS): total price to product item

Markup formula

To calculate markup, use this formula:

Markup = price – COGS

To calculate percentage, use this markup formula:

Markup percentage = (price – COGS) / COGS

Now let’s look at a hypothetical example to put the markup price formula to work:

You sell clothing and accessories at your store. For the sock product that you carry, you’ve calculated that the COGS is $5/pair. Customers can buy these socks for $15/pair. Here’s how to do the calculation using the markup formula:

Price = $15

COGS = $5

$15 – $5 = $10

The markup is $10. To calculate the markup ratio:

($15 – $5) / $5 = $10 / $5 = 2

That means that the markup ratio was 2:1. In other words, the markup was 200%. You marked up the price of the socks by 200%.

Using the percentage is valuable because this guarantees a certain level of profit, regardless of fluctuations in production costs.

For instance, let’s say you always mark up the socks by $10. The COGS goes up significantly; it’s now $15 to produce a pair of socks. You sell them for $25, a 40% markup. You’re still making $10/pair, but your profit margin has decreased. If you used a fixed markup of 200%, you’d sell the socks for $45/pair, increasing your profit margin.

And that segues us into the next section: the margin formula.

Margin formula

To calculate margin, use this formula:

Margin = price – COGS

To calculate margin as a ratio to then get a percentage, use this formula:

Margin = (price – COGS) / price

Let’s look at our example again. For the socks with $5 COGS that go for sale at $15/pair, you’d calculate the following:

Price = $15

COGS = $5

$15 – $5 = $10

Your gross profit margin is $10/sale. To get the margin as a percentage, which is more useful, you’d do the following:

($15 – $5) / $15 = $10 / $15 = 0.67

The gross profit margin ratio is 0.67, and the gross profit margin is 67%. Note how the $ amount for the markup and margin were the same, yet the percentage is different. This is another example of how the percentage is more insightful.

Remember how our COGS changed to $15/pair? When you sell them for $25/pair, the margin is 40%. But when you sell them for $45/pair, the margin is 67%. Keeping a fixed markup as a percentage can help you keep consistent profit margins — again, regardless of fluctuations in COGS.

Margin vs markup chart

We’ve seen what margin and markup are, how they’re different, and a bit of how they’re related. The margin vs markup chart further illustrates the relationship between the two metrics.

As demonstrated in our example above, when you adjust the markup, you’re also affecting the margin. You can use a margin vs markup chart to easily correlate the two metrics. This is helpful if you’ve set a profit margin goal, so you can identify the markups needed to help you attain that goal.

| Markup | Margin |

| 15% | 13% |

| 20% | 16.7% |

| 25% | 20% |

| 30% | 23% |

| 35% | 25.9% |

| 40% | 28.6% |

| 45% | 31.03% |

| 50% | 33% |

| 75% | 42.9% |

| 100% | 50% |

Markup vs margin: How to use them in pricing

High-growth brands understand the difference between markup and margin and when to use markup vs margin in their pricing strategies. As we briefly mentioned earlier, you might have a gross profit margin goal. Establishing that target margin will help you determine how much to mark up products.

Some retailers have markup-based pricing. Also noted before, this fixed markup means that you add a certain dollar amount or percentage (in dollars) to the COGS to establish the price for the customer. This results in varying margins.

But markup and margin aren’t the only factors for pricing. Remember those $45 socks? They normally sold for $15/pair. If your COGS went up drastically, and you increased the price $30, it’s unlikely that customers will still want to purchase.

Savvy data-driven companies know that data isn’t meant to be looked at through a single lens. The metrics come together to paint the bigger picture of what’s happening in your business and with your customers. Markup and margin as just two pieces of the bigger puzzle.

Definition: Markup is a term used to define the difference between the cost of any good, service, or financial instrument and its current selling price. In other words, it is the result of subtracting selling price minus cost.

What Does Markup Mean?

What is the definition of markup? Mark-up can also be defined as the gross margin of a sale, but the term is normally used in different contexts. A product markup is added by the retailer to obtain a profit from the transaction. This mark-up can also be expressed as a percentage of the sales price or as a percentage of the cost.

In the financial markets, this term is used to describe the difference between the offering price, which is a price given to market dealers, and the final price the customer pays for the security; this is a regular term used between market participants such as dealers or brokers.

Let’s look at an example.

Example

American Spare Parts Co. is in the business of selling U.S. manufactured aftermarket parts. The company’s best selling products are spark plugs. American Spare Parts buys all its spark plugs, regardless of the model of the car in which they will be used, at $0.5 per unit and sells them at $0.8 per unit. To increase sales, the company is offering a sales promotion for customers buying 4 spark plugs at once. The cost of buying the four units together would be $2.8. What is the company’s current markup per each spark plug sold and how much would it be when the promotion starts?

As we saw previously, the markup formula is sales price minus cost. This means that the current mark-up is $0.3 per spark plug. When the promotion starts the company’s sales price per unit will be $0.7 if the client buys the 4 of them. This means that the mark-up drops for the promotion to $0.2 per spark plug.

Markup Meaning Pricing

Summary Definition

Define Markups: Markup means the excess retail price of a good over the retailer’s cost of the good.

Markup Price Meaning Examples

Contents